PSD2 is coming soon. Banks have time until September 14, 2019, to adapt to the European directive — from this moment, a real fight between traditional financial institutions and FinTech will start.

The situation is heating up, especially since Facebook is preparing to hit the financial market. For now, however, only a handful of applications that use PSD2 are worthy of interest.

The financial industry changed significantly in recent years. The primary reason responsible for that is digital transformation. One of the leading global financial institutions, Deutsche Bank, recently announced that it plans to let go of 20,000 employees worldwide.

In Poland, the tendency looks similar. Bank Pekao S.A. in 2018 conducted the "Voluntary Departure Program," which involved 915 people and was aimed at employees preparing for retirement at the time. By October 31, 2019, the bank's plans, in turn, included terminating up to 950 employees.

This is influenced not only by the financial industry's troubles but also by technological transformations. The majority of customers who years ago dealt with matters at a bank branch today do that with a smartphone or computer.

Further changes in banking are heralded by the European Union's directive PSD2 (Payment Services Directive 2), which will make it possible for bank customers to use applications provided by third parties.

It will become possible to manage, for example, three bank accounts (e.g., Bank Pekao S.A., Millennium Bank, and mBank) in one place, both in terms of checking the balance, transaction history, and making payments.

Will PSD2 create competition for banks?

The new regulations will affect the structure of the entire market. 41% of representatives of banks admitted that in the first year after the implementation of PSD2, their main competition would be other banks. However, in the three-year timeframe, they're most concerned about competition from technology companies (32%) and especially the "Big Four" — Google, Amazon, Facebook, and Apple (53%).

Banking institutions face the challenge of continuously selling their offers. When logging into Pekao's mobile app, for example, the customer sees an offer of an express loan that can be used without leaving home. In the meantime, the person that will choose a financial application (mobile banking software) from another provider won't see such an offer.

Data analytics plays an essential role in customer acquisition, and developers of new financial services are betting on it to a larger extent. All of this is based on the principle that if you are already reaching out to the consumer with an offer, only select the one who will use it.

Facebook made a fortune thanks to personalized ads; that is, it hit a profiled customer with a specific proposal. It obtained knowledge of their expectations through the information that the user themselves provided. Meanwhile, banks have only recently realized the role of micro-personalization.

Diem (Libra). How much will Mark Zuckerberg mix things up?

With Facebook comes the problem of competition affecting the banking sector. Because Mark Zuckerberg will launch his own cryptocurrency Diem (Libra). In the longer term, financial products such as loans will be linked to Diem, which will noticeably hurt banks.

Especially since Diem will not be another Bitcoin-like cryptocurrency. Mark Zuckerberg will create, to a large extent, real currency, but based on blockchain.

Experts predict that Diem can threaten the stability of the global banking system and privacy, the appropriation of which has become the domain of the 35-year-old multi-billionaire. Diem will be used by those who install the Calibra app on their phone.

In addition, the currency will be available in messengers that belong to Facebook — Messenger, and WhatsApp. By the way, it's amusing how Mark Zuckerberg is fiercely monopolizing the market by getting rid of most of the competition by systematically buying it.

The main difference between current cryptocurrencies and Diem is that assets will secure its value. We're talking about bank deposits or government bonds, while a consortium of companies joining the project will be responsible for management. This involves a payment of at least $10 million in exchange for the right to vote.

Money has so far been put up by PayPal, Spotify, Mastercard, and the big stock market loser, Uber, among others. With the launch of cryptocurrency, the number of members of the Diem Association nonprofit foundation will reach 100 companies. The reserves provided by consortium members will be replenished successively from money obtained during the exchange of foreign currencies.

Diem will likely succeed, especially since customers will benefit from it without paying a fee. What's more, Diem won't be subject to excessive exchange rate risk, which other cryptocurrencies are famous for. It will probably bring money to Facebook over time, for example, through the already-announced loan offer.

The tech giant may put bank accounts at our disposal — most likely using PSD2, especially since Facebook has already asked large US banks to share data on customers' financial situations (account balances and payment card transactions). However, it justified it with other motives.

FinTechs are already gaining strength, and this is just the beginning

The European directive PSD2, even though it increases security, e.g., through a more complex authentication process, primarily escalates the battle between technology companies and the banking sector, which has been going on for a long time.

Just see how much interest services such as N26 or Revolut have gained in recent years. N26 allows individual clients and companies to have a mobile account in euros, and they receive a free payment card from Mastercard as a part of the deal. Revolut enables users to pay in 150 different currencies with a single payment card — without fees, commissions, or spreads.

The appearance of PSD2 brings another flood of applications that will help manage individual and company finances. Let's take a look at the few most interesting ones.

Remember that the mere collection of data from various accounts by third parties is not a problem — Automatic Identification System (AIS).

However, bank transfer service requires the Financial Supervision Commission authorization — Payment Initiation Service (PIS).

Wallet: improved financial management

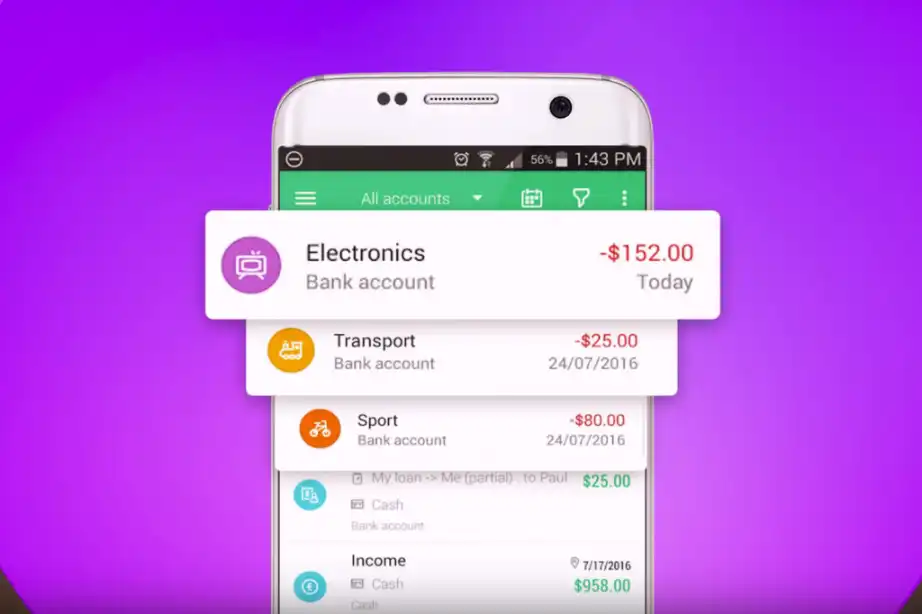

Prague-based startup BudgetBakers has created an app that helps users track spending and save money. Today, Wallet provides services for customers worldwide, gaining the most interest in the US, Russian and Indonesian markets.

The application has gathered over 300,000 active users and was downloaded over 3 million times.

Wallet allows users to plan budgets and track spending flexibly. Thanks to the application, they manage finances by taking into account different currencies and financial institutions.

Wallet is designed to enable users to plan their finances even over several years. A function that fits with the PSD2 policy is the ability to share selected accounts with trusted people.

BudgetBakers is one of the few FinTechs who have obtained a Czech National Bank license. This license guarantees Wallet direct connection with data in APIs (API for business banking).

Once the customer gives their consent, Wallet will automatically receive transaction information straight from the banks.

"Until now, banks had a monopoly on their customer's transactional data, but now they will make it available to FinTech, which will improve innovation in finances. This is precisely what the European Commission aimed for with the PSD2 directive.

We want to continue to develop Wallet with as many financial innovations as possible. That is why we were among the first to apply for a license back in January 2018," says Michal Kratochvíl, CEO of BudgetBakers.

Wallet currently supports the following banks in Poland: Alior Bank, Bank Zachodni, Idea Bank, ING Bank, mBank, and Bank Millennium.

Token Open Banking: receive money on time

Token Open Banking, the brainchild of Silicon Valley entrepreneur Steve Kirsch, is an open banking platform that received $16.5 million from investors in June 2019.

The venture, established in 2015, helps aggregate customer account information from multiple external sources (AIS), as well as initiate direct bank payments and reduce their acceptance costs (PIS). More than four thousand banks are currently connected to the platform.

Token Open Banking has gone beyond the ordinary data platform because it created its own cryptocurrency Token X, except based on "real" money.

When someone sells goods or services online to individual or company consumers, receiving timely cross-border payments is a priority for them.

Token Open Banking and Token X allow them to reduce expenses and make immediate transactions.

HSBC Mobile Banking: finances on a larger scale

HSBC International Bank, which also has a corporate branch in Poland, has released the HSBC Mobile Banking application. In the UK alone, more than 300,000 users have downloaded it and gained access to all bank accounts in one place, including the HSBC competition — Barclays and Lloyds.

HSBC Mobile Banking has many interesting functions. It allows users, among others, to categorize expenses and receive information on how much money they'll have left after paying their bills.

Raman Bhatia, who was in charge of digital business at HSBC in the UK and Europe, admitted that users love that, thanks to their application, they can see their finances on a larger scale.

Additionally, Raman Bhatia said he is counting on using customer data and artificial intelligence to make it easier for customers to access loans. "I think the long-term vision for the banking sector as a whole is to provide very predictable, contextual access to nonproduct-related loans," he states.

Artificial intelligence will allow companies to personalize offers so that they're as tailored as possible to the individual recipient's needs.

This is what the registration process at HSBC Mobile Banking looks like.

Lookout App Defense SDK: additional protection

PSD2 makes the authentication and payment transaction process require even stronger security features than before. Among other things, the directive aims to provide greater security, which is an excellent opportunity for the Lookout App Defense SDK, an application that offers so-called proactive protection, all the more critical regarding the company's money.

68% of banking operations are currently made with the help of mobile applications. The European Commission hopes that with the introduction of the new directive, mobile banking will become more integrated, secure, and efficient.

External applications will not be created without a mechanism to monitor for signs of malware (malicious software), but additional security is no less necessary.

The Lookout App Defense SDK scans the smartphone for malware, among other things, as early as during the activation and authentication process.

In case of danger, the application counters Trojans, bots, or spyware.

Moreover, Lookout is integrated with TEE (The Trustonic Trusted Execution Environment), which provides additional protection by allowing sensitive data to be stored in the phone's "safe enclave."

Who else is developing PSD2-based business applications?

Although PSD2 creates many new business opportunities, I found only four credible applications worthy of attention and presentation while preparing this article.

In Poland, only a handful of companies have experience with PSD2. In The Story, we've dealt with designing and specifying requirements of a business application based on PSD2 and AIS, PIS, and CAF services.

Hero shot: Henry Burrows / Flickr.com / https://bit.ly/2ZiWYcX / CC BY-SA 2.0