Entrepreneurs are usually creative people with inquisitive minds. They constantly generate and select ideas. This article is about the selection of business ideas.

Being selective regarding the ideas we want to take further is one of the most difficult (and crucial) choices we have to make.

Let's go back to Mike, a lawyer and an entrepreneur who wanted to have more clients while doing less.

In the article on Personas, I described Mike's situation. He didn't have much money to spend on targeted marketing, so the young entrepreneur needed to maximize his budget by ensuring that every lead cost as little as possible. Mike was choosing between Personas who were:

- Starting their adventure in business.

- Already running companies and were looking for an investor.

- Wanting to sell their company or shares in it.

- Planning to invest: business angels, accelerators, funds.

- Looking to buy a company, e.g., competition.

How do you choose the best market segment for your service? How do you find the right market niche? For Mike, the most important selection criterion was the ease of obtaining a lead online — the person who's just starting their adventure with business. It was less important to him how much he could potentially earn by handling investment funds. However, first things first.

Choosing a market segment for a startup

Level one: Choosing the critical success factors for our business idea

Mike wanted to choose the best market segment for launching his business. When compiling a list of critical success factors, he took into account only those that were directly related to his problem. For example, the cost of reaching a potential customer and the size of the market were more important to him than geography.

Books on management even say that one should not study all the factors of success but only choose 20% of them that are the most relevant. This 20% will be responsible for 80% of success or failure.

To decide, Mike has compiled a list of the most important criteria:

- Market size.

- The cost of reaching a potential customer.

- The level of competition "attacking" the same segment.

- Customer expectations towards the quality of service.

- The price that the customer can pay for the service.

- Customer openness to new service providers.

Level two: Evaluation of critical success factors and determination of their value

At this stage, Mike had to give different weight to each of the factors because not every potential customer was as important to him. When determining the level of importance of factors, it is recommended to think in terms of one to three points. This facilitates both weight evaluation and final calculations.

While making the assessment, Mike asked the question: How important is a given factor for my service?

- Three — very important.

- Two — medium importance.

- One — not important.

Since all factors on Mike's list were very important, they received the highest priority — three.

To assess the value of individual factors, Mike prepared a scale of one to five, where five is great (a lot and easy), four — is above average, three — is medium, two — is below average, and one means bad and difficult.

Segments

In order to be able to apply the scale to each of the factors, Mike explained each of them with questions. He knew how important it was to use the same criteria for each of the five assessed segments:

- Market size. Are there a lot of clients in this area?

- Easiness to reach potential customers. How easy is it to reach the client?

- The level of competition that "attacks" the same segment. Is it easy to fight competition in this segment?

- Customer expectations towards the quality of service. Is it easy to meet customers’ needs?

- The price that the customer can pay for the service. How much is the customer willing to pay?

- Customer openness to new service providers. How open is the customer to a new provider?

Mike placed a list of factors along with specific questions under each of the assessed segments, along with the appropriate weight criteria. Thus, he began to determine the actual value of the factors.

While answering each question, Mike used publicly available information (statistics, news on economic portals) and industry knowledge he had obtained so far.

Important questions

Let's go through the abovementioned questions one by one.

Are there a lot of people starting their adventure in business? In the third quarter of 2019, 87,788 business entities were registered, which is 2.6% less compared to the same period from last year — according to data from Statistics Poland. This result deserves a rating of four.

Are there many funds and investors? The Polish Investment and Trade Agency reported that it worked with a variety of foreign investors who financed 71 projects in 2018. Their value exceeded 2.13 billion euro, while in 2015, it was 500 million euro.

We should add that 130 venture capital funds are operating in Poland, and the total value of investments made in 2018 amounted to 177.9 million euro, according to the "Golden Book of Venture Capital in Poland" report by the Startup Poland Foundation.

These numbers deserve a rating of three. It's easy to make such a rating. The number three is in the middle of the scale, whereas extreme ratings affect the final grade the most.

Is it easy to meet the needs of a given group of customers? For people who are just starting their adventure with business — yes, very easy (rating of five). Unlike experienced players from funds or companies that buy their competitors, such people have few requirements.

Satisfying the expectations of experienced players (e.g., investment funds) is very hard (rating of one). But unlike novice business people, funds pay more, and since they pay more and have high requirements, they are served by experienced, larger law firms. The funds are reluctant to change lawyers and aren't guided by advertising on Google or Facebook when doing so.

Level three: Multiplying the weight of factors by their value and adding up the final result

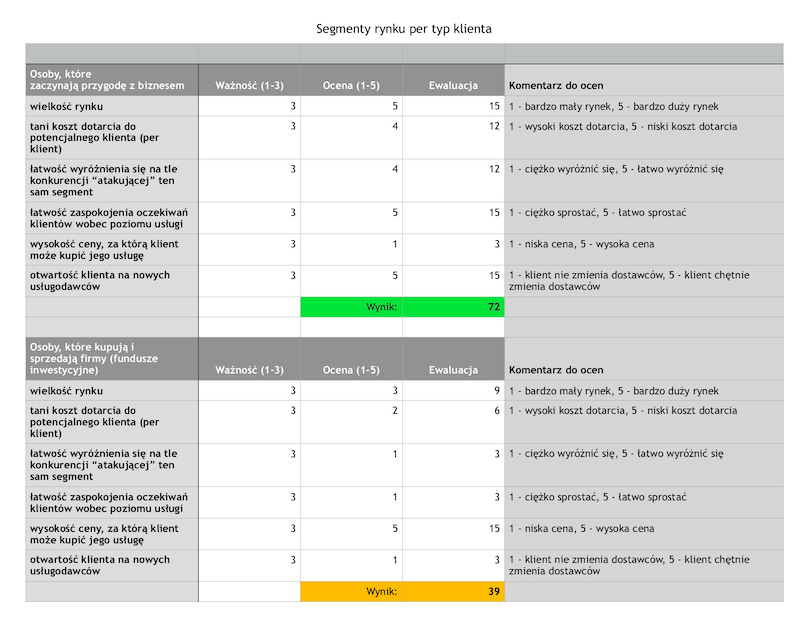

Mike created a table where he assigned a rating to each question in a given segment.

Then he multiplied the weight of the criterion (three) by the actual weight of the factors. He added them up and received a value for each segment. The higher this value turns out, the better the segment is from Mike’s perspective.

The segment of people who are just starting their adventure in business received a rating of 72, and the investment fund segment, although it looks more prestigious, received a rating of 39.

Analysis of critical success factors

This method allowed Mike to analyze critical success factors to decide which market segment is the most attractive to him. Mike made a more analytical and less emotional decision. The method allowed Mike to exclude factors such as prestige, ambition, and the feeling of belonging to a selected group of people.

A brief analysis of critical success factors

When you have several options to choose from when deciding on a business idea and looking for a niche market you could enter, you can use this method of analyzing critical success factors:

- Choose critical success factors.

- Assess critical success factors and assign values to them.

- Multiply factor weights by values and add them up. This will create a ranking arranged from best to worst options.

Product Design and choosing a niche market or how to implement a business idea

I have used the analysis of critical success factors in practice several times. Recently, I was implementing a project in the field of service and product design for a medical startup.

The company's president needed to make a preliminary selection from almost 40 ideas for service segments. We provided a tool that made it possible to make a selection through the analysis of critical success factors. In this way, we found a market niche and selected four business ideas for the team so they could prepare prototypes and then test them. We saved a lot of time and money for the customer who would fail if he had to test all the ideas or if he chose the wrong one.